Rust to Tech: Part 3

- Published: February 28, 2022

By Susan Stansbury, Industry Consultant

This is Part Three in a five-part series. Part I was a look at the rust belt image, concentrating on mills making substrates and related converting; Part II was a snapshot of converting examples with associated suppliers and technologies. This episode is a reminder that converting and associated industries have made a leap from the old rust belt days into a world of technology and forward motion.

Here are examples of the latest converting technologies with notes on their associated markets.

We cannot look at the state of the industry without first commenting on workforce issues. Manufacturing, like almost the entire U.S. labor force, is in dire need of workers. Both individual companies and organizations are working to bring in new employees.

Some companies are going to high schools and technical colleges themselves. Others work with groups to reach workers. According to Ann Franz of the NEW Manufacturing Alliance, “We are targeting both new workers and ‘upscaling’ workers for better jobs such as data analytics across industry in HR, IT, the plant floor and more.” There are some 300 member companies.

In recent years, there was some irony in companies wanting to automate, eliminating certain workers, with accompanying negative news about fewer jobs available. Now, the combination of automation and a leaner workforce seems like a win-win. Automation and improved workflow steps portend a future with a smaller workforce. Being lean and productive has kept the Midwest converting hub globally competitive.

There is further encouraging news for the converting world which many say is “headquartered” in Wisconsin. Madison, with a population of 250,000, led a list of the top 10 cities that retained tech talent from December 2019 to May 2021, according to LinkedIn analysts. In addition, Green Bay, the scene of so much converting, is growing along with industry. The engineering talent pool in the Midwest is also a positive factor supporting manufacturing.

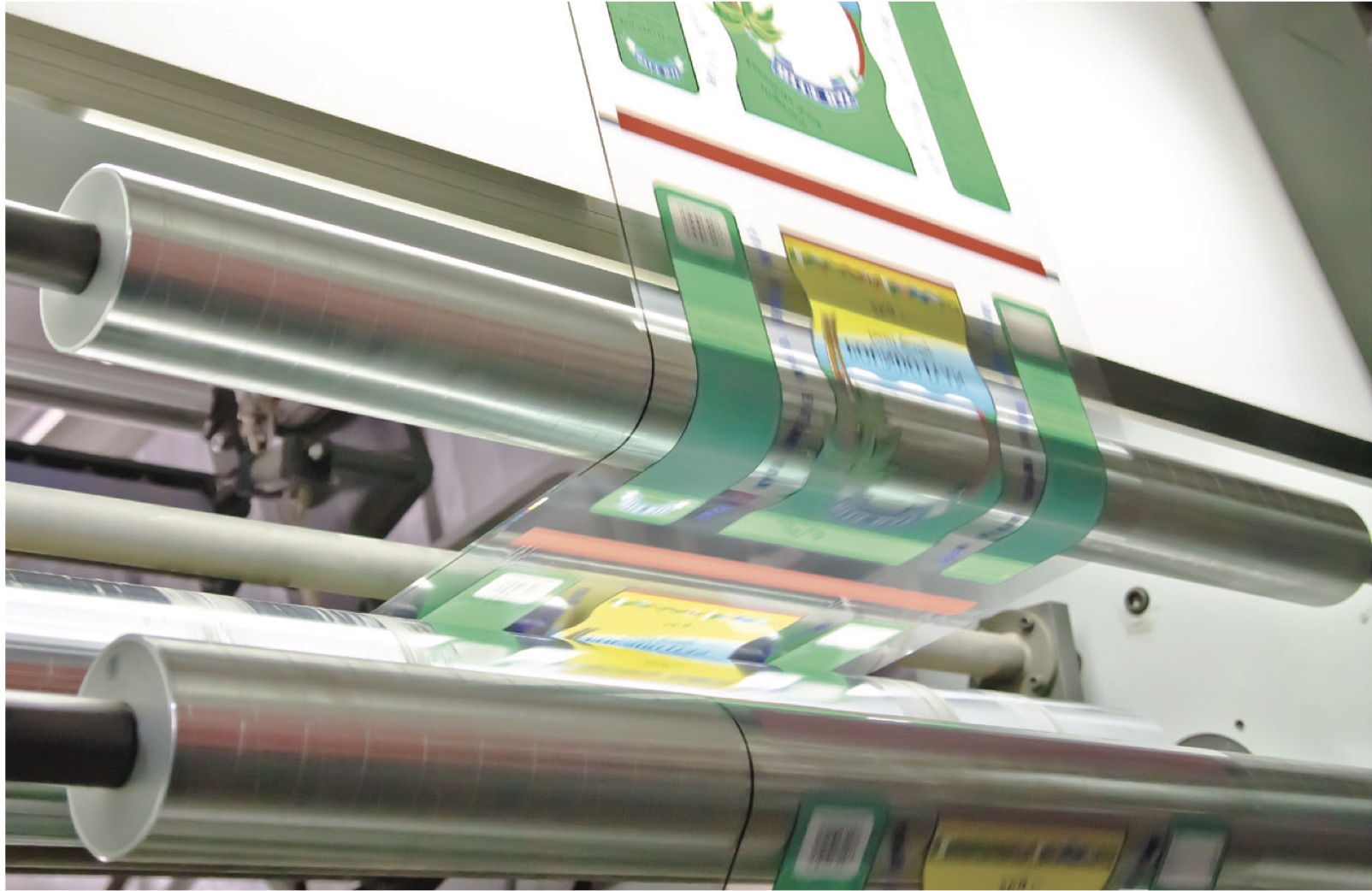

Looking at aspects of the converting industry, from slitting-winding, coating, printing, production processes, packaging and more, a major focus is on efficiency. In a recent webinar, web handling experts Maxcess International reported, “Optimizing your converting yields better quality output, faster speeds and decreased scrap. The key to optimizing converting is not simply proper guiding or tension, but it’s about the interplay of all these tools.”

According to Mary VanVonderen, marketing manager, The CMM Group, “Companies are spending money on new equipment and expanding production in many of our core markets. We also see an uptick in companies taking proactive steps for preventive maintenance and upgrading existing equipment.” Providing industrial ovens, conveyorized dryers and pollution control equipment are key aspects of the company’s business.

Like many others, The CMM Group is increasingly examining ways to cross-learn and develop between its diverse divisions. One of its newest offerings grew out of the ovens segment. Now, for example, Infrared (IR) cheese premelters play a vital role in the frozen pizza manufacturing process, ensuring that cheese and toppings stay in place during the flash-freezing and packaging process.

For each converting process, providers are offering improved equipment. Beginning with slitting-winding, there is no standing still. Elite Cameron states its turreted slitter rewinders combine both efficiency and flexibility. In the spring of 2021, Elite Tape introduced its new CAT 729 fully automated surface rewind slitter. It was custom built to meet market demands. And others are doing their part with custom solutions.

A 2021 U.S. Packaging Machinery State of the Industry reports U.S. packaging machinery shipments rose 14.7 percent between 2015 and 2020, with a packaging order backlog increase of 22.3 percent and a converting order backlog increase of 12.2 per- cent in the same period. Welcome to backlogs!

Companies in health care disposables such as dry and wet wipes are rolling out new products like masks and reusable wipers. Associated raw materials have evolved with the unique product designs. In market niches ranging from pizza packaging to retail and automotive, growth and backlogs prevail in 2022.

Automation, RFID, lighting, recycling, intellectual property and sustainability are simultaneous factors during this period of innovation. Examples:

- Measuring sustainability at Menasha Packaging happens in many ways — including in number of trees saved!

- Menasha Corporation’s Neenah, Wis., facilities, through upgrades to LED bulbs, save 375,000 kWh a year.

- Georgia Pacific’s Palatka, Fla., paper mill earned the U.S. Environmental Protection Agency’s (EPA’s) ENERGY STAR Top Project for 2020. The mill’s kraft papermaking department team achieved a 40 percent water reduction.

According to AdvisorSmith.com reporting, manufacturing strongholds are often in mid-sized and small communities, such as in Indiana and Wisconsin. The top five small cities they cite include Colombus, Ind.; Sheboygan, Wis.; Lima, Ohio; Decatur and Kankakee, Ill.. The “Converting Corridor” from Green Bay to Milwaukee, Wis., is the innovation hub of this important segment of manufacturing.

Next: Part IV of this series will include more aspects and upgrades in converting.

Next: Part IV of this series will include more aspects and upgrades in converting.

About the Author

Susan Stansbury is a converting advocate with extensive experience in the paper, converting, printing and related industries serving in roles including sales and marketing management.