The Powerhouse of Contract Converting

- Published: March 27, 2023

By Susan Stansbury, Industry Consultant Contracted manufacturers occupy

Contracted manufacturers occupy much of the U.S. production landscape. With overall strong growth, there are still variations by product and market category, from healthcare to industrial and branded merchandise. While the national media still claims we do not make much in America anymore, contract converters know better. Perhaps part of the misconception is due to the fact that the Midwest “fly over” country is at the heart of manufacturing.

According to the Association for Contract Packaging and Manufacturing, “The Midwest continues to dominate... with the majority of headquarters locations as well as overall facility and volume density.” With the Midwest at 41 percent overall in contract manufacturing, the next closest region is the Northeast at a distant 19 percent. The Contract Packaging Association also estimates CAGR at a healthy 10.2 percent.

The Association’s summary (contractpackagingreport.com) further shows that more than half of contracted firms do more than $25 million in business. The range is mere millions to billions of dollars. Not that many years ago, there were worries that automation would deprive workers of opportunity; now automation has allowed manufacturers to grow in an atmosphere of hard-to-get workers.

A discussion with American Custom Converting of Green Bay, WI, shows the range, markets and growth exemplary of many contract converters in 2023. Peter Bekx, a managing member, tells of recent business highlights:

- ACC has recently removed five major production assets and brought on four by the first quarter 2023. These include two wide web slitters. One of the new slitters handles small diameter rolls where they do contract converting for “blanket curing concrete.” They helped their contract customer develop the converted laminate.

- In another case, ACC supplies a major healthcare partner where ACC makes laminated patient gown materials, and the customer completes the product.

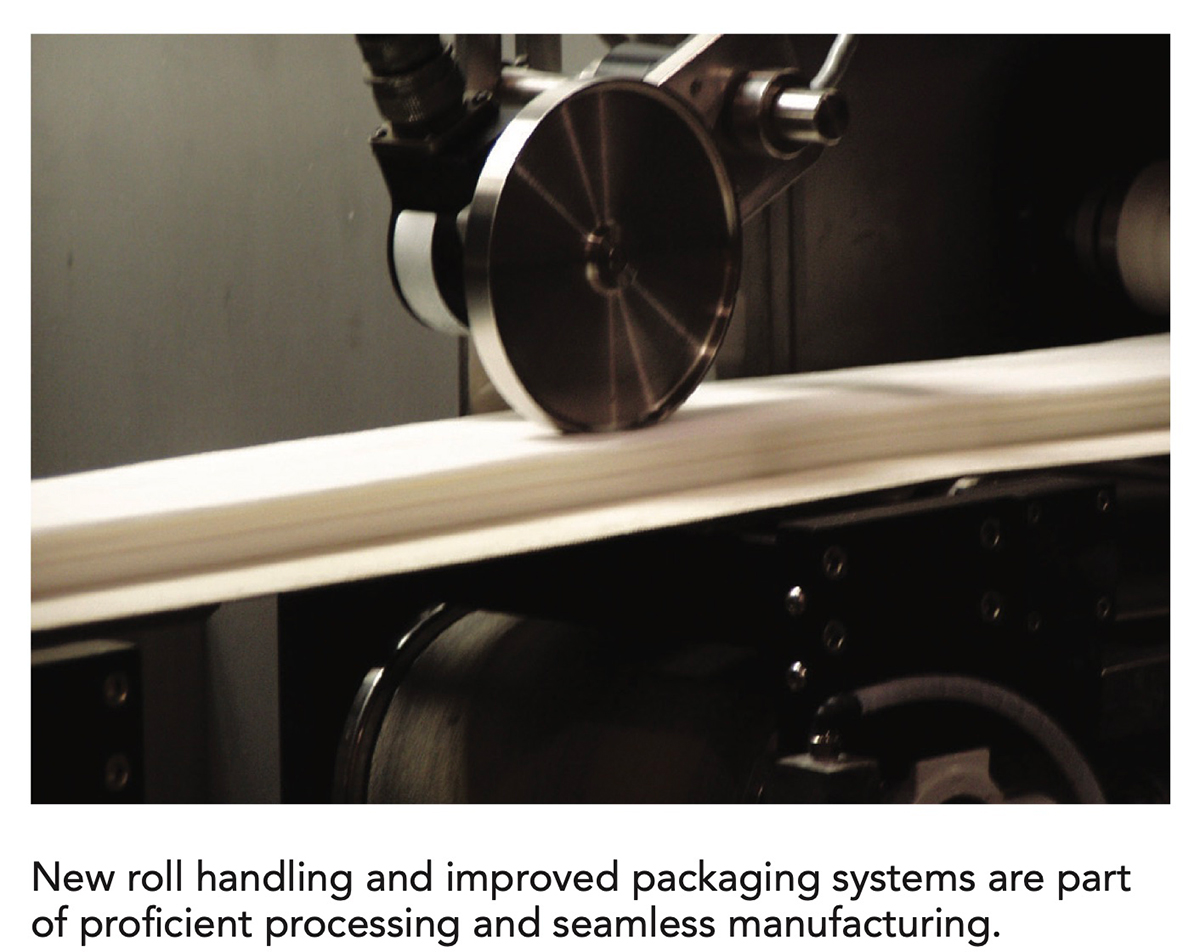

- Further automation throughout the business has led to more efficiency and increased streamlining of their processes. New roll handling and improved packaging systems are part of proficient processing and seamless manufacturing.

- More investment with fewer employees is a hallmark of ACC’s approach to its growing business. In fact, sales growth has exceeded 25 percent in each of the last two years, all while decreasing labor costs. “The new growth revenue has been plowed back into business assets to support new customer initiatives,” said Bekx.

- ACC’s contract manufacturing often includes problem solving based on customers’ wish lists. New equipment as well as redesigned and repurposed lines show its special contracted value.

Other industry insiders note that while growth is strong in many sectors, there are also challenges. According to Michael Kryshak, CEO of Rebel Converting, “Some of the converting industry is becoming ‘congested’ in terms of new capacity and competition.” With the ability to convert 2.1 billion square yards annually into wipes, Rebel Converting is a force in the coreless roll/canister wipes business. As a contract manufacturer, Rebel is partnering with its customers across retail, healthcare and business-to-business segments — to maximize the opportunities that exist in today’s marketplace.

With the advancements in innovative products being developed, contracted manufacturers also play an outsize supportive role in delivering results for their partners. From substrates to converting and packaging, they are demonstrating value with their latest capabilities. Barring the potential effects of a recession, forecasts are bright for the industry.

About the Author

Susan Stansbury is a converting advocate with extensive experience in paper, converting, printing and related industries serving in roles including sales, marketing and product development.