Hit the Brakes!

- Published: December 31, 2004, By Robert W. Marsh, Contributing Editor

Economic Outlook

Petroleum literally and figuratively lubricates the world’s business. Petroleum products are everywhere: from the gasoline pump to the frames for eyeglasses to flexible packaging materials, the computer mouse that steers computers, and the bottles that hold soft drinks and filtered water. These are only five of the thousands of products made with and from petroleum all over the world. That’s why the rise in the price of crude oil hurts.

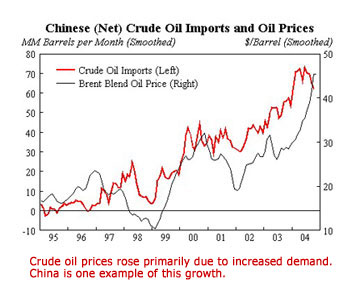

The demand and, consequently, the price of crude oil rose sharply over the last three or four years as the global economy heated up, according to Robert C. Fry Jr., senior associate economist for DuPont. Interviewed the day before Thanksgiving, he said, "With very little excess capacity and an inelastic supply in the short run, the increase in demand triggered a price increase that took prices to about $55 per barrel in August of last year, up $30 from its low in May 2003. Last November, it slumped to the $48 range." (As of December 3, it had slumped to about $43.)

In Fry’s view, "high oil prices have slowed economic growth by reducing discretionary income, squeezing profit margins, sapping consumer confidence, and widening the US trade deficit, factors that may cause a global slowdown."

Evidence of Slowdown

Evidence of the slowdown is apparent, particularly in Japan and Western Europe, according to Fry. "Japan’s GDP grew at just a 0.3 percent annual rate in the third quarter (of 2004), down from 1.1 percent in the second quarter and a robust 6.3 percent in the first quarter. Japan’s diffusion index of leading economic indicators fell to 27.3 percent in September, the first time since March 2003 it has fallen below the neutral level of 50 percent.

"In the Euro-Zone, GDP growth slowed from a 2.8 percent annual rate in the first quarter to 2.0 percent in the second quarter and 1.2 percent in the third. In the United Kingdom, where growth had been strong, GDP grew at only a 1.6 percent annual rate in the third quarter versus 3.6 percent in the second.

"Yet," Fry says, "despite high oil prices and downturns in leading indicators, the US economy remained relatively resilient. GDP grew at a 3.9 percent annual rate in the third quarter of 2004, down from 4.5 percent in the first quarter but up slightly from the second quarter’s 3.3 percent rate." However, the Conference Board’s index of leading indicators suggests the economy is slowing down as we enter the new year.

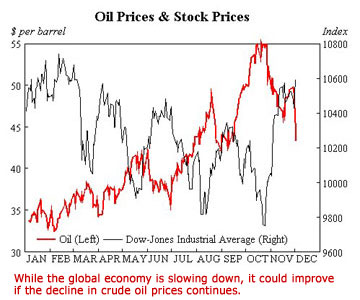

"Although current economic data and most leading indicators point to a continued slowdown in the global economy," Fry continues, "things could be looking up longer term if the decline in crude oil prices that began in October continues. Unfortunately, the time lag from an oil price reduction to its effect on economic growth is four to five quarters, so oil prices could continue to weigh on economic growth until the end of 2005.

"Thus, we are forecasting a mid-cycle slowdown, similar to those in 1985 and 1995. Both times manufacturing was flat for six to ten months, then started to grow again. After the slowdown of 1995, we had four years of good growth. The US isn’t heading for a recession, but we do expect a slowdown."

World Trade

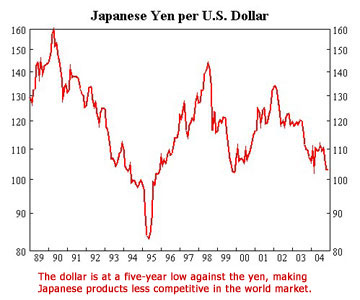

"The US dollar is at a nine-year low against the euro and near a five-year low against the Japanese yen," says Fry. "This has made US goods more competitive relative to European and Japanese goods and has put European and Japanese manufacturers in the same difficult position US manufacturers were in two to three years ago."

The weak dollar, according to Fry, benefits some groups in our economy and hurts others. "The weaker dollar is going to hurt us as shoppers who buy imported products, but it is going to help us in our role as manufacturing sector employees.

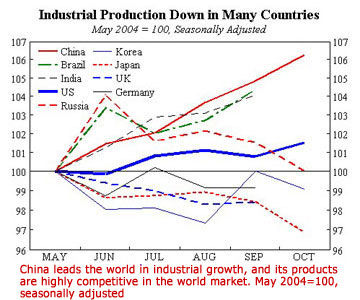

"China’s yuan," Fry explains, "is pegged to the dollar and has been undervalued since it was devalued in 1994. But recently, it has become even more undervalued as the dollar weakened, and their products have become even more competitive in the world market.

"China’s industrial growth is displacing production in the US and may be hurting our manufacturing output and hampering employment. On the other hand, the increasing availability of relatively inexpensive Chinese goods is holding down inflation and, to some extent, creating a demand for capital goods," says Fry.

Industrial growth is not the only way China is displacing US production and hampering employment. Offshoring production, customer service, and other work moving to China, India, the Philippines, etc., also is having an impact on employment and investment in America.

Offshoring and Outsourcing

Offshoring and outsourcing of services and processes are two methods US and European companies use to cut costs and improve profitability.

The term "outsourcing," according to Dr. William Llewellyn, is "the practice of the acquisition of services from specialist suppliers, including payroll management, plant maintenance, logistics, and distribution. Most often, outsourcing occurs within the same country." Dr. Llewellyn is senior consultant with AWA Alexander Watson Assoc. of Amsterdam, The Netherlands.

"Offshoring" Dr. Llewellyn says, "is the acquisition of finished goods or services from companies based in other countries. Such services or processes may have been an integral part of the offshoring company’s original practices."

Offshoring work to China and India by American companies is more than simply a matter of lower wages versus US wages. There are other valid reasons, according to Dr. Llewellyn. One of them, he says, "is a reliable supply of highly skilled individuals. In India, for example, the labor force contains highly skilled plant operators and supervisors, plus junior and middle management personnel.

"Investment in new plants and equipment in China and India," says Dr. Llewellyn, "is continuous and at a higher level than it is in North America and Western Europe. Companies in India and China regularly commission state-of-the-art plants for the manufacture of base films, inks, and coatings, as well as advanced converting and coating equipment including wide-width coaters, vacuum metallizers, printers, and laminators, all providing for lower-cost manufacture.

"These facilities serve not only their own developing markets but offer opportunities to US and European companies to purchase the high quality products they need, often at significant cost advantages."

The rapidly growing economies of China and India and resultant domestic demand also support investment in technology. China’s GDP is rising at about 9%, according to Dr. Llewellyn, and industrial production is growing by 16%. India’s GDP is rising at 7.4% and industrial production is up 8%.

The introduction of new technologies and the replacement of inadequate or outdated equipment also are cited by Dr. Llewellyn as justification for investment.

Demographics plays an important part in the decision to offshore production for Western European countries. "The population of Western Europe is aging and shrinking," says Dr. Llewellyn. "By 2050, more than 40 percent of Europe’s population will be older than 60. The total population is shrinking by around one million people per year, at the current birth rate. The demands and ambitions of an aging population are very different from those of the younger populations of India and China, two countries that account for 33 percent of the world’s births."

It would appear the benefits of outsourcing and offshoring will continue to attract US and European companies for some time.

Bad News and Hope

Crude oil prices … leading indicators … outsourcing … offshoring … economic slowdown.

Where’s the hope?

At the end of this tunnel. As the economy slows and the demand for crude oil declines, the price of petroleum also may decline, helping the economy grow stronger. Although a significant improvement may not occur until the end of this year, with a little luck, the light at the end of the tunnel could become a beacon that leads the way to strong economic growth à la 1995.

Robert W. Marsh, former executive director of the Assn. of Industrial Metallizers, Coaters & Laminators (AIMCAL), is a retired marketing communications manager for ICI Americas, where he managed advertising, sales promotion, and product publicity for Melinex polyester films. Prior to joining ICI, he handled a variety of advertising assignments for the DuPont Co.

Robert C. Fry Jr. joined DuPont’s Economists’ Office in 1987 following a three-year stint in Conoco’s Coordinating and Planning Dept. As senior associate economist, he analyzes and forecasts global macroeconomics and its impact on DuPont. He assists DuPont businesses by interpreting economic data and using it to forecast DuPont performance. He is also the author of the monthly newsletter, "Current Business Developments."

Fry received his B.S. in economics from Ohio Univ. and an M.S. as well as his Ph.D. in economics from Harvard. He is past-president of the Board of Visitors of the Honors Tutorial College of Ohio Univ., a member of the Economic Roundtable of the Ohio Valley and the National Assn. for Business Economics. He is a frequent speaker at trade association meetings and DuPont customer events.

Dr. William Llewellyn is an associate of AWA Alexander Watson Assoc. and an independent international business and technical consultant. He has a doctorate in chemical engineering and more than ten years in senior management positions with Van Leer Metallized Products, UK.