UV/EB | North American Market for Energy Curing Technologies

- Published: January 27, 2015, By Jackie Bland

PRIMIR study provides the latest word on ultraviolet and electron beam curing in printing.

PRIMIR’s newest study, “UV/EB Curing Technologies in Printing,” which was recently conducted for PRIMIR by I.T. Strategies, is a first-of-its-kind look at the North American market for UV/EB curing technologies in print applications. The study provides an overview of energy-curing technologies, sizing of each market segment, technology drivers, and growth rates along with implications for graphic communications print providers and vendors.

PRIMIR’s newest study, “UV/EB Curing Technologies in Printing,” which was recently conducted for PRIMIR by I.T. Strategies, is a first-of-its-kind look at the North American market for UV/EB curing technologies in print applications. The study provides an overview of energy-curing technologies, sizing of each market segment, technology drivers, and growth rates along with implications for graphic communications print providers and vendors.

The research strategy looked at the market from a user, manufacturer, and brand owner perspective. Users included commercial printers, packaging converters, screen printers, digital, and specialty print providers. Brand owners and more than 25 manufacturers also were interviewed.

According to Steve Metcalf, president & CEO of Air Motion Systems|AMS UV, who served as co-chair of the PRIMIR task force guiding this effort, “In 2012, about 15 percent of all printing equipment and supplies expenditures were spent on energy-curing ink technology. This PRIMIR study was commissioned to provide clarity and focus on the energy-curing print market, and to identify major barriers and opportunities, such as LED UV, for further adoption.”

What is Energy Curing?

Energy-curing inks and coatings are high-performance chemistry used in the printing industry for applications where productivity and durability are at a premium. There are two main types of energy-curing ink systems: ultraviolet (UV) curing and electron beam (EB) curing. Both rely on matched ink and curing systems to cause a molecular reaction, which causes the ink to fuse to the substrate once exposed to the energy-curing light (UV) or electrons emitted (EB) by the curing system.

According to the study, there is no other ink technology that offers the same instant dry advantages offered by energy-curing inks. UV-curable ink technology accounts for 96% of energy-curing printing equipment and supplies manufacturer revenues. There are three core UV-curing system technologies that are used with offset, flexography, screen, gravure, and inkjet printing presses:

- ARC curing

- Hybrid UV-curing (referred to as H-UV)

- LED-curing

The three variations of UV-curing systems can co-exist on the same press.

Reportedly, energy-curing ink technology in many instances is less expensive to operate than conventional ink technology from an end-to-end perspective—even with a higher cost of UV-curable ink formulations. In addition, output quality tends to be more consistent, and often more vibrant than conventional inks.

Adoption Trends

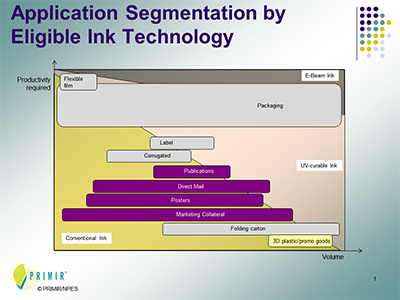

Many commercial printers and packaging converters do not fully understand the technology, its benefits, and return-on-investment potential. The economics of energy-curing inks are such that they are not suitable for all printing applications. In commercial print, the use of UV-curable inks and coatings is greatest in direct mail applications, while in package printing, UV curable inks are used most commonly in folding carton applications.

Commercial printers are still early in the life cycle of acceptance of UV-curable printing technology. There is a pervasive perception that UV-curable printing systems are too expensive and won’t provide a clear return-on-investment. Many commercial printers do not get beyond this initial impression to further explore the benefits and true ROI calculations. A single common denominator among commercial printers who have “taken the leap” to enjoy the dividends from energy-curing technologies, is utilization of an MIS software system that helps them realize ROI/economic advantages of an UV-curable system.

Packaging converters are adopting energy-curing ink technology more quickly than commercial printers, mainly because the return-on-investment calculations are compelling. In package printing and converting, converting is the most profitable. Energy-cured technologies enable converters to speed up the lower-value print process significantly and allow them to quickly get to the higher-value converting process. Packaging converters also tend to have higher profit margins than commercial printers, helping them to overcome initial investment hurdles in deploying energy-curing technology.

Proportionally, the usage of energy-curing inks by applications is summarized in the exhibit below.

Electron beam (EB) curing is primarily found in high-volume folding carton or laminated flexible packaging applications where the packaging often comes in contact with food. With significant acquisition costs, but decreasing steadily, EB has limited usage in a select few applications to date. Electron beam technology accounts for about 4% of all energy-curing ink technology equipment and supplies manufacturer revenues.

On a continuum, energy-curing printing equipment and supplies manufacturer revenue accounted for approximately 15% of all conventional printing equipment and supplies manufacturer revenue in 2012. About 40% of this revenue was spent on equipment, 40% on inks, and the balance on curing systems, plates, blankets/rollers/other, and coatings.

Incidentally, 10% of the total UV-curable printing equipment and supplies manufacturer revenue is generated from inkjet technology. Currently, UV-curable inkjet printing applications are mainly limited to wide format display graphics, labels, and decorative/coatings applications.

As noted, commercial printers are still in the early stages of acceptance of UV-curable technology. Aside from the initial investment expense, printers cite that there is a steep learning curve. Operators have to re-learn ink balance, roller shear, blanket lift, etc. Printers that have adopted energy-curing technologies often had to switch supplies manufacturers as they learned which inks/plates/rollers worked best with a particular substrate or in a particular application. The PRIMIR study noted that “using UV-curable presses is an art not all operators can easily learn. Those who have successfully adopted energy-curable systems speak of the “UV Dividends,” among them, customers received a better, more consistent product, and operators saved significant time.”

Future forecast

Based on the research, the PRIMIR study forecasts that the share of energy-cured ink could reach upwards of 25% of the industry within the next decade. Energy-curing systems manufacturers are optimistic about the outlook, in part because energy-curing is one of the few areas of universal growth in an industry that is broadly in decline. These suppliers are optimistic that organic growth in demand for packaging, coupled with desires for greater efficiencies in the packaging industry will drive more business toward energy-curing ink technology.

In conclusion, the PRIMIR study “UV/EB Curing Technologies in Printing” projects a 2.5% or greater combined growth rate for energy-curing printing manufacturers through 2017 in North America. While print providers and packaging converters still find it difficult to invest with ongoing price pressure and overcapacity issues, productivity and efficiency benefits from energy-curing ink systems are tangible, and those who have adopted the technology can’t foresee going forward without it. With increased education about the benefits realized from energy-curing technologies, the forecast for 2017 and beyond is bright.

About the Author

Jackie Bland, research director for PRIMIR/NPES, has extensive experience in the graphic communications industry. A majority of her career has focused on industry trade association activities. She spent 25 years working at Printing Industries of America, where she was executive director of GAMIS. In 2005, she moved to NPES to launch PRIMIR and continue in the role of providing valuable and insightful market information about the future of the graphic communications industry.

PRIMIR, the Print Industries Market Information and Research Organization, is the research unit of NPES The Assn. for Suppliers of Printing, Publishing and Converting Technologies. For more information about this and other PRIMIR research, please contact Rekha Ratnam at PRIMIR/NPES. She can be reached via e-mail at: rratnam@primir.org or by phone at 703-264-7200. Visit www.primir.org for information about membership, PRIMIR future research, and upcoming meetings.